Our Love and Hate Relationship with Bitcoin Miners

source: Bitcoin News

2018. Apr. 03. 21:55

It’s coming close to a decade since the creation of the bitcoin network and the cryptocurrency ecosystem. The protocol has produced a great deal of users, infrastructure, businesses and influential parties like developers and miners. Since the beginning of bitcoin’s mining history, individuals mined lots of coins with central processing units (aka home computers). Later, characters like Artforz started the graphics processing unit (GPU) arms race, a moment in history that eventually led to a world of application-specific integrated circuit (ASIC) mining which changed the game significantly.

Also read: Trezor to Implement Bitcoin Cash Addresses

Proof-of-Work: Why Are Our Incentivized Custodians Often Considered ‘Evil’?

The cryptocurrency ecosystem is made up of a diverse group of people, but some specific ‘pools of individuals’ offer a great resource by securing the crypto economy for an incentive. Love them or hate them, bitcoin miners have been processing our blocks for years, the very blocks that hold the millions of transactions broadcast throughout the network. Even though miners have been simply following the protocol as it was written, these individuals have always been deemed ‘tendentious’ by certain groups and social figures within the cryptocurrency industry. Mining pools have suddenly become ‘evil groups’ who are allegedly planning malicious attacks on the network.

Artforz Becomes the Bitcoin Community’s First Mining Villain

Through an incentive-based system called Proof-of-Work (PoW), miners are rewarded with freshly minted coins when they find a new block. In the early days, guys like Satoshi Nakamoto and Hal Finney mined BTC with CPUs for the very first year of bitcoin’s life. However, not too long after, an anonymous individual called ‘Artforz’ figured out how to get large GPU mining farms to harvest BTC. Artforz, who controlled a lion’s share of hashrate at the time, started a vexed community argument that made Satoshi ask the community to slow the mining arms race down.

“We should have a gentleman’s agreement to postpone the GPU arms race as long as we can for the good of the network. It’s much easier to get new users up to speed if they don’t have to worry about GPU drivers and compatibility. It’s nice how anyone with just a CPU can compete fairly equally right now,” explains Nakamoto.

Back in 2010, it was said that one individual named Artforz controlled a great majority of the BTC network hashrate.The Age of Application-Specific Integrated Circuits

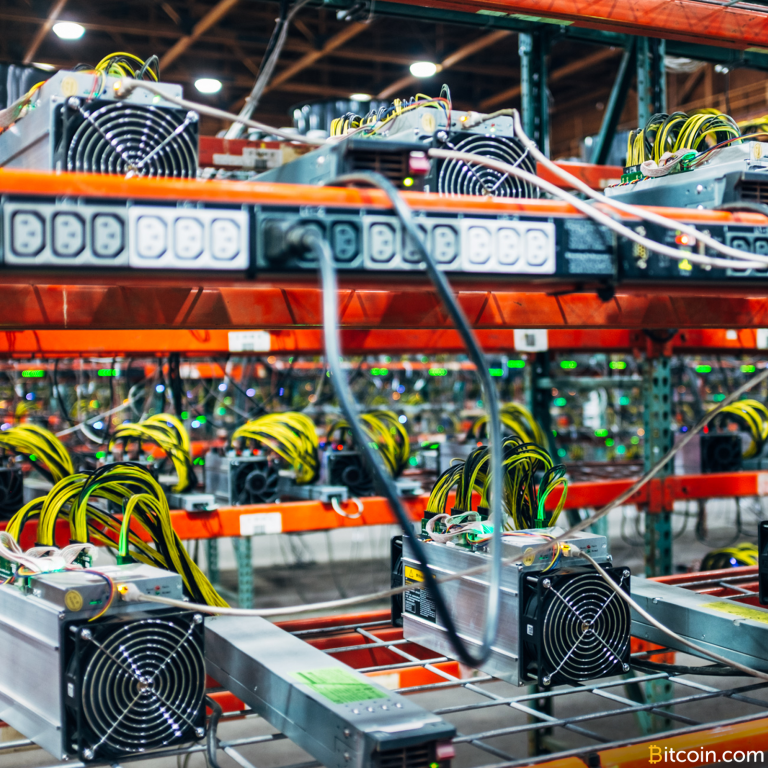

An ASIC device.A few years later, after Nakamoto left, numerous manufactured ASICs entered the scene, changing the industry forever. Gone are the days when bitcoins were mined from home computers, and they can’t be mined with GPUs either because the machines will not profit. These ASIC devices and their operators have become a central theme of discussion amongst cryptocurrency network participants for a long time. There have been also been many ASIC manufacturers, and lots of them failed, but some of them have lasted since the early days. Since the ASIC evolution began, the mining industry has been targeted for numerous disputed subjects like using too much electricity and colluding together to sabotage the network.

Remember When Ghash.io Controlled 51% of the Network?

Fears of mining conspiracies have plagued the crypto-community for quite some time after ASICs pushed GPU farms out of the picture. Soon after ASICs appeared, solo mining and ‘home mining’ individually, even with ASICs, became unprofitable for solo miners so many of them started mining in ‘pools.’ Groups of pools can find blocks easier and profits are split between the members with a contractual agreement. In the early days, only a few pools existed, but over time more groups joined in on splitting the network’s hashrate. In June of 2014 one pool sparked a significant amount of controversy.

The Ghash.io incident is often forgotten, but in the summer of 2014, this pool commanded over 51% of the BTC network hashrate.At that specific time, the mining pool Ghash.io was commanding more than 50 percent of the network hashrate, which theoretically meant that pool could reject validated transactions. This event caused an uproar in the community and made the headlines of mainstream media. Eventually, the heated arguments died down and ultimately Ghash.io dissolved into smaller factions.

‘Selfish and Greedy Miners’

A year later in December of 2015, the Scaling Bitcoin conference got the community fired up once again as a viral photo of almost 70 percent of the network’s hahsrate pool operators sat on one stage. At the time, mining pools such as F2pool, Antpool, BTCC, Avalon, and others graced the stage together for the first time to discuss the scaling debate. Year after year since then, miners have been plagued with conspiracy and accusations of being “selfish and greedy miners” — the very thing the bitcoin protocol frames them to be.

This photograph caused quite a stir in 2015 as the picture represents nearly 70 percent of the BTC network hashrate at the time.Last year the discussion got controversial once again as the community raged against the use of covert ASIC Boost mining. This specific controversy, among other conspiracies, caused some proponents and developers to start talking about changing bitcoin’s PoW consensus. At the time the alleged use of covert ASIC Boost mining caused cryptocurrency-centric forums and Twitter feeds to erupt in vitriolic energy. The subject has started making rounds again throughout forums and social media as the community is now discussing an ASIC Boost patent and mining pools using the technology overtly.

Miners Continue to Process Blocks — Despite the Negative Sentiment

The fact is no one can really explain why miners are constantly disliked and crucified for their actions, but yet they have been since the dawn of the code. The dispute over mining has caused the subject to trickle down into other cryptocurrency communities as well. ASIC mining has caused some digital asset teams, like Monero for instance, to contemplate changing their consensus algorithms in order to avoid ASIC domination at all costs. In addition to this, the BTC network hashrate is processing over 28 exahash per second, even during a time when mining has become somewhat unprofitable in some regions, signaling that miners still believe.

Why do you think miners get such a bad reputation throughout the cryptocurrency ecosystem? Let us know what you think about this subject in the comments below.

Images via Shutterstock, Scaling Bitcoin Hong Kong, the Brady Bunch, Bitcoin.com, Ars Technica, and Antpool.

Make your voice heard at vote.Bitcoin.com. Voting requires proof of bitcoin holdings via cryptographic signature. Signed votes cannot be forged, and are fully auditable by all users.

The post Our Love and Hate Relationship with Bitcoin Miners appeared first on Bitcoin News.