Hyperinflation Crushes Venezuela as Global Devaluation Ramps Up

source: Bitcoin News

2019. Jul. 02. 21:15

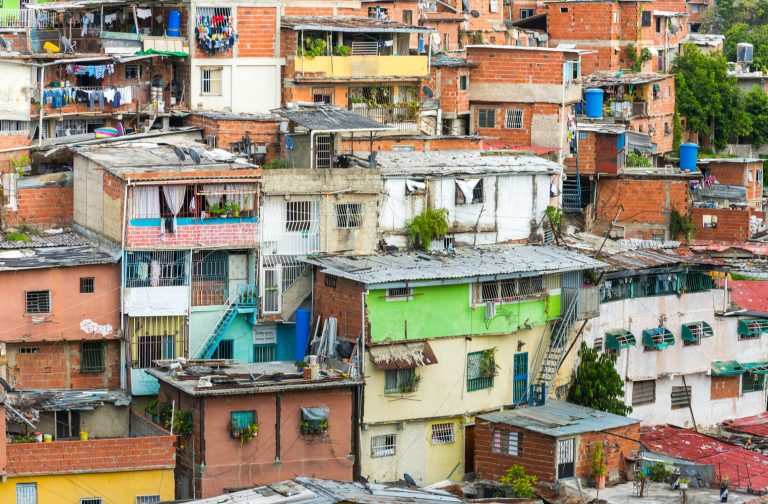

Venezuela is being crushed by staggering hyperinflation as a sharply divisive political crisis has the economy in ruins. Some are seeking refuge in alternatives to the national currency, like foreign fiat and crypto. The situation also calls into question the long-term trajectories of other, less volatile economies. National banks globally have been consistently struggling to balance fiat value against interest rate policy now for decades.

Also read: Iranians Defy Warning and Share Pictures of Bitcoin Mining in Mosque

Soaring Inflation in Venezuela

Hyperinflation in Venezuela has been projected by the IMF to reach 10,000,000% some time this year. The Venezuelan AN (Finance Committee of the National Assembly) puts the final inflation rate for 2018 at 1,698,488.2%. According to recent statistics, that number has since fallen below 1,000,000%, but the reasons for this are unclear, and the numbers are being called into question.

While data from different government agencies and economic research groups vary, what is agreed upon is that the Venezuelan bolivar (VEF) has been rendered almost worthless. With the divided Venezuelan government in shambles, an economic crisis has emerged where consistent and reliable data is not easy to come by. And more importantly, where basic survival has become a challenge for large numbers of individuals living in the country.

Venezuelan Government Reports Questionable Trends

Recent inflation data, released for the first time in three years by the Venezuelan Central Bank (BCV) itself, indicates positive trends of month-to-month decreased inflation and CPI.

While the BCV report presents a somewhat positive outlook, others disagree. According to venezuelanalysis.com, the situation is not bright or favorable at all:

This is something we’ve been stressing: the essence of the anti-inflationary policies consists in shrinking people’s purchasing power as much as possible, so that they won’t buy dollars in the black market, – those who could afford it – thus stabilizing the exchange rate. But more than that, the goal is that people, in general, buy less of everything so that there’s less pressure on prices to go up.

The reported statistics thus might be simply a reflection of a drastically shrivelled GDP, and cherry-picking research methods. At street level, the Venezuelan bolivar is virtually lifeless, and the government has already had to issue bills of strikingly large denominations to keep up.

People are frequently paying for goods with black market USD, purchased illegally due to high demand and strong restrictions placed on official market channels. To get an idea of just how staggering the numbers are, a video by Youtube channel Livelydata (based on IMF statistics) provides an eye-opening comparative analysis.

Inflation in Other Countries

Venezuela currently leads the world in national inflation, but this doesn’t mean that other countries remain unaffected by global trends. While the top 10 countries hit hardest by hyperinflation include Venezuela, Zimbabwe, Sudan, Argentina, Iran, South Sudan, Liberia, Yemen, Angola and Turkey, the worldwide trend is one of declining purchasing power as well.

In Sweden—ranking only 102nd globally for inflation—the value of the krona (SEK) dropped to a 17-year low in April, arguably due to the Riksbank (Sweden’s central bank) delaying interest rate hikes. While some isolated indicators and speculation point to upcoming signs of strength based on Riksbank interest rate policy and the manufacturing sector, the macroeconomic trends remain questionable.

In the U.S., ranking just six spots above Sweden on the IMF chart, the dollar does not seem to be faring much better. According to London-based research group Emerging Europe, the June 19 tumble of the USD below the 97 handle was a result of the Federal Reserve’s dovish policy to maintain current interest rates. The argument being that many global and emergent markets were hoping for a shot in the arm via slashed prices. It noted:

“The dollar fell below the 97 handle on June 19, with the index falling as low as 96.57 during the day’s trading. This decline was a clear response to the Fed’s reiteration of their willingness to, at the very least, maintain interest rates at their current level. In all likelihood, those interest rates will be slashed to stimulate the global economy.”

Global Devaluation of Currencies

Compared to other countries, Venezuela’s inflation crisis may seem incomparably dire. The exponential rate of economic downturn dwarfs analogous statistics of other economies. Analyzing trends in currency devaluation in Sweden and the U.S., however, results in consistent devaluation data as well, just at a much, much slower rate.

From the perspective of sustained, macroeconomic movement, both the USD (the world’s largest reserve currency) and SEK are in a steady, decades-long decline. $1 in 1958 would be the equivalent of $8.86 in 2019. 100 SEK from 1958 would equal 1,284.14 SEK today.

According to research by Deutsche Bank, the inflationary decline of value globally (via a median global rate) stretches back for centuries. It has compounded in the 20th century by a large-scale departure from commodities and metals-based systems, in favor of increasingly credit and debt-based models. Jim Reid (of the same group) writes:

As the twentieth century progressed, pressure against precious metal currency systems rose, and many countries periodically suspended their memberships and loosened policy. Inflation ensued.

Venezuelans Turn to Bitcoin, But There Are Real Challenges

Attempting to weather the crash, some Venezuelans are using cryptocurrencies like bitcoin. Venezuelan economist Carlos Hernández claims that although conversion can be difficult due to state restrictions:

…you could say that cryptocurrencies have saved our family. I now cover our household’s expenses on my own.

Others don’t see crypto helping in a significant way.

“There are no official statistics of how many crypto wallets there are in Venezuela. There’s no way to know how many each person owns. What … is very clear is that beyond a couple of businesses that accept this form of payment and a few trusted exchange platforms online, there are no services for crypto users available in the country.” This is the view of Diana Aguilar, who only recently left the country in the midst of its collapse.

Caracas, VenezuelaHernández had been using the popular peer-to-peer trading website localbitcoins.com to facilitate domestic bank transfers. Statistics from the site detail a marked increase in exchange volume for the VEF/BTC pair beginning around 2018. Though opinions on what the best solution is differ, the bolivar has now become a real economic liability for Venezuelans.

What are your views on the global economic situation, and the information issued by the Venezuelan government? Let us know what you think in the comments section below.

Image credits: Fair use, Shutterstock

Did you know you can verify any unconfirmed Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin address search to view it on the blockchain. Plus, visit our Bitcoin Charts to see what’s happening in the industry.

The post Hyperinflation Crushes Venezuela as Global Devaluation Ramps Up appeared first on Bitcoin News.